LUNA Break Down

As you know, Terra(LUNA) and UST token collapsed within a few days, and people faced despair for the fantastic system. At the head of May, LUNA's price is over $100 and now is under 0.1 dollars.

Why does that thing happen?

As of now, I catch several clues about LUNA Crush and try to understand about series of them.

As you know, LUNA's strong point is simply the APY of Anchor Protocol. Anchor is one of the fascinating projects of DeFi, Most DEX can not provide a service like that.

But, LUNA's system is practically more fragile than you think. UST token certainly pegs to USD all the time. But Once things happened, the UST price suddenly separates from the USD. It is crazy.

LUNA's protocol allowed to realize the crushing of system, And several knowledgable economists pointed out their weak system.

First Attack

LUNA's perfectly broken event started from Curve protocol. The curve is a decentralized exchange for stable coins, and it is recently one of the biggest DEX in the world.

Anchor protocol's high APY has no time to sustain without outside backup. So Do Kwon the founder of TeraStation lab and LUNA's CEO wanted to enter the liquidity pool in Curve also known as '3pool'.

To transfer the UST coin from LUNA's ecosystem to Curve, the LUNA side tries to withdraw it. Attackers politely check this behavior, and a mass of UST is sold by them at the same time.

So UST price a little bit drop down and breaking the peg to USD.

On May 9, the UST price is $0.9, this is a very abnormal situation for a stable coin. But price-drop didn't stop at all.

The more UST price down, the more LUNA price breaks down. It is a feature of the terra system and the problem for them.

Most professionals think the Attacker is not mature and has a lot of money, make a plan to break the system before.

Relation to Curve War

Curve finance is a well-known DEX among crypto natives. You can join as LP by rocking USDT or USDC, DAI in 3pool. And they reward LP token 3CRV, 3CRV is a clue to get CRV token in that protocol.

CRV token is most important on Curve Finance. If you have a lot of CRV, you can choose the pool to boost liquidity power. Last year, plenty of DEX including anchor join this game to get CRV tokens. This is Curve War.

I think that Curve War is the most vital event for DeFi, and change the game for provider and developer. LUNA team's strategy maybe slips out this time.

Now and Future of LUNA

After the crush of LUNA, Do Kwon revealed a plan to revive that project. But many people perfectly lost trust in LUNA. In addition, Binance CEO CZ warned about terraformLabs correspondence.

USDT that stable coin peg to USD also prices down to $0.96, LUNA shock remaining as bad memory among the crypto community.

Bitcoin and Ethereum are slightly broken in a short span, and cryptocurrency will enter a long winter from now on.

On the other hand, algorithmic stable coins like UST or TITAN are collapsing to zero every time, this kind maybe can not use in the market forever.

投稿者の人気記事

NFT解体新書・デジタルデータをNFTで販売するときのすべて【実証実験・共有レポート】

Bitcoin史 〜0.00076ドルから6万ドルへの歩み〜

2021年1月以降バイナンスに上場した銘柄を140文字以内でざっくりレビュー(Twitter向け情報まとめ)

バイナンスの信用取引(マージン取引)を徹底解説~アカウントの開設方法から証拠金計算例まで~

【第8回】あの仮想通貨はいま「テレグラム-TON/Gram」

CoinList(コインリスト)の登録方法

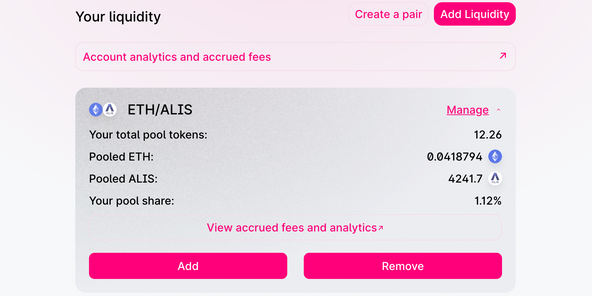

Uniswap(ユニスワップ)で$ALISのイールドファーミング(流動性提供)してみた

【初心者向け】$MCHCの基本情報と獲得方法

17万円のPCでTwitterやってるのはもったいないのでETHマイニングを始めた話

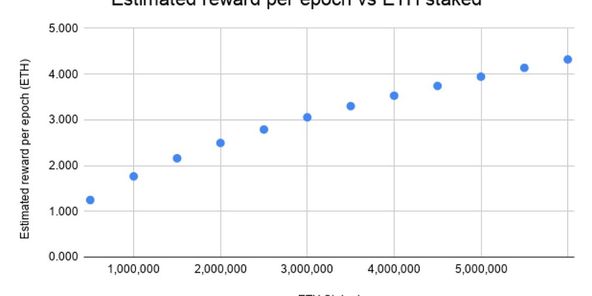

Eth2.0のステークによるDeFiへの影響を考える。

ジョークコインとして出発したDogecoin(ドージコイン)の誕生から現在まで。注目される非証券性🐶